Blog Summaries – Some Good News!

Market #’s

Many people are worried. They point to the news, which they say hasn’t been good lately. The Chinese have cut the value of their currency, oil prices are falling, earnings reports from some big companies have been disappointing, the Fed is threatening to raise interest rates, Greece is threatening to default on its debt, and Puerto Rico already did. It’s easy to be frightened into thinking that further market losses might occur.

But there’s more to these stories that you need to be aware of:

- Yes, China has cut the yuan. But many economists note that the impact on the U.S. economy will be minimal. As a consumer, you’ll likely notice that products made in China will become cheaper – which is good news for you.

- Yes, oil prices are falling – but that means you’ll save even more money at the gas pump. Everyone who buys fuel wins – trucking companies, airlines, and homeowners reliant on oil to heat their homes. There are losers, too – mostly the energy companies that make money selling oil. (And here’s the most ironic aspect of today’s oil prices: when oil was trading over $100/barrel, some people were scared that the high prices would hurt consumers stuck with high gas bills. Now that oil is $40/barrel, those same people are fretting that drilling companies will lay people off. Some people just choose to always be unhappy.)

- Yes, some companies have released disappointing earnings reports. But these companies are nevertheless earning huge profits; Wall Street analysts simply expected them to be earning even more. Consider one big-name stock: it reported a 3-month profit of $11 billion, but its stock fell 7% on the news because analysts were expecting the company’s profits to be even higher. You just can’t please some people!

- Yes, Greece is threatening to default. But so what? They’ve been making that threat for nearly a decade. And so what if they do? Greece’s economy is smaller than Connecticut’s. You won’t notice unless you’re vacationing in Greece.

- Yes, Puerto Rico is in default. For years, we’ve advised our clients to avoid municipal bonds. If you own them, you should obtain advice now.

And yes, there’s a lot of other news you probably don’t even know about. The housing industry is one of the most important to our economy, so you ought to be aware of what’s happening there:

- According to the National Association of Home Builders, home builder sentiment is at the highest level since 2005

- According to the National Association of Realtors, sales of existing homes are at the strongest pace since February 2007

- According to the Commerce Department, housing starts are up 13% and now at the highest level since December 2007. Also, applications for permits to build more homes is up 16%

In other words, Americans have been buying lots of houses. Builders are building lots more, and have filed paperwork to build even more after that. No wonder Barclay’s has issued a research report saying that “construction activity is rising across the country, a positive signal about the health of the U.S. consumer and the overall economy.

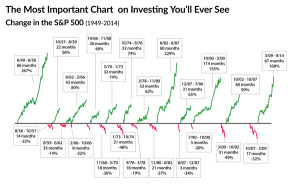

If you need further reassurance, consider the chart below.* It shows the performance of the S&P 500 since 1926, highlighting periods when the market is rising and those when the market is falling. As you can see, bull markets last a long time and prices rise a lot, while bear markets are short-lived and incur only small price declines in comparison.

There’s something else that this chart shows you. Every bull market is followed by a bear market. And every bear market is followed by a bull market.

In other words, since 2009 we’ve been enjoying rising prices. Now, for the moment, we’re experiencing falling prices.

More Sage Advice

While lots of people are panicking, we urge you not to. As stewards of money, we recognize something that many people seem to forget: economies — and markets — have cycles, and their record for coming out of downturns is 100%. Downturns are where bargains come from. Volatility is an outward manifestation of fear, and it is rarely the case that a market is both afraid and extremely overvalued ….

There are companies — lots of them — that we loved from an awesomeness perspective that were just too expensive. Many of these are being repriced as investors flee the market, and we are ready to react. There are some high quality companies that had previously been priced to perfection, and now they are not…..

Here is how bizarre the crisis in China is: over the last year the bellwether Shanghai SE Composite Index is still up more than 40%. That’s not just a good year for most markets, it’s a stupendous one.

We have built our business to take advantage of times of market distress, just like this. Keeping our wits when others appear to be losing their minds and focusing our efforts.

Get more knowledge—visit the knowledge center home page.

Since 2003, Insight Financial Group has been serving the needs of of successful families. Take two minutes and four seconds and learn more about the Insight LifePath.